Consumers Foresee a More Cautious Future

As COVID-19, the disease caused by the coronavirus (SARS-CoV-2), continues to spread across the globe, MAi/Pathfinder have been busy conducting research to try and understand the resulting impact on the American consumer’s behaviors and attitudes.

One of the topics we’re exploring is the long-term social impact that consumers anticipate after the outbreak has passed. Our data shows that most consumers (85%) expect the outbreak to have a lot or some impact on society after it has passed, while 69% say there will be a lot or some impact on how they personally conduct themselves day-to-day.

But what sort of impact are they talking about?

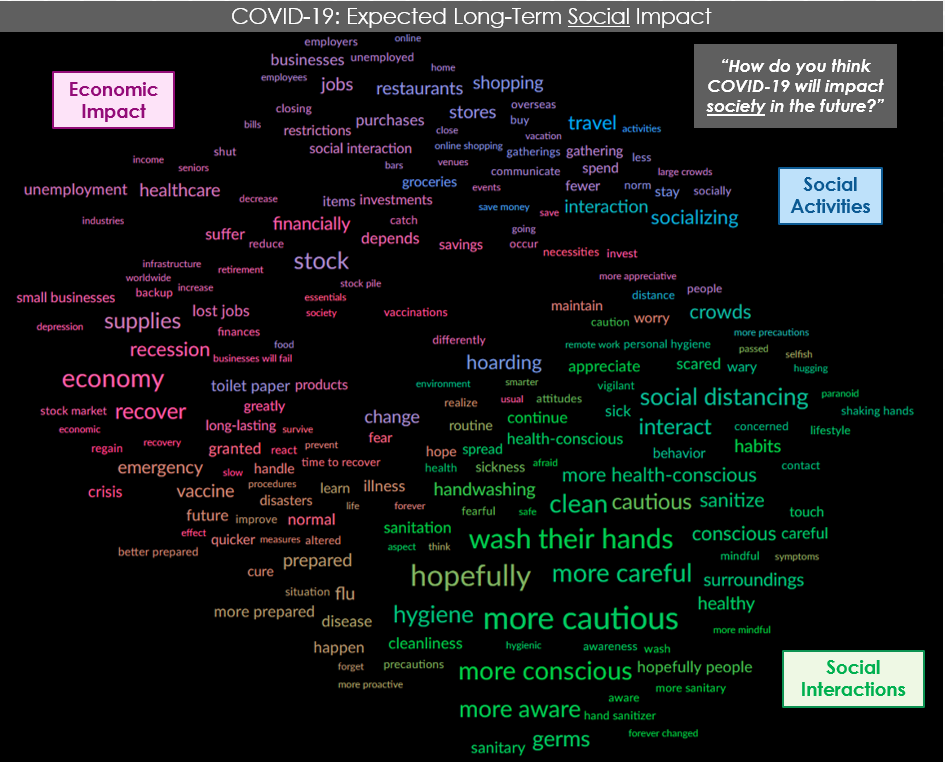

To better understand the nature of these expected changes we applied our Pathfinder Text Science methodology to a series of open-ended questions eliciting consumers’ vision of the post-coronavirus future. The resulting concept map reveals that consumers see three primary areas of impact on society:

The Social Impact Map reveals how n=1,287 consumers expect the COVID-19 outbreak will impact society in the long run. (Click to enlarge)

Note: When reading a Pathfinder Text Science map, the size of a word reflects its overall importance to the data set; its proximity to other words shows the strength of the association between them; and its color reflects its connection to the map’s main themes.

A Lingering Economic Impact: Consumers foresee higher unemployment rates, a possible recession or even depression, and potential changes to the country’s healthcare system. As a result, some also look for changes in people’s spending, saving, and investment behaviors, with a trend towards saving more and spending less.

“We will probably be in a recession for a long time, with many people losing their jobs. People will not invest in the stock market as much as before and will hoard certain items for a long time to come.”

“Even if a big financial bounce does take place it will take many months or maybe years to recover. It will depend on the length and severity of this crisis and the methods of recovery employed worldwide, both economically and socially.”

A More Cautious Approach to Social Interactions: Consumers anticipate a pronounced shift in the ways people interact socially, with a greater emphasis on both personal hygiene and personal space. Beyond this, however, they also expect that the experience of living through the outbreak will cause many people to take on a more cautious, careful outlook towards life in general.

“I think we will look at each other differently and be more scared to get close. This is going to be so strange when it’s over. Personal space, personal hygiene, financial, travel, working from home, how we shop—so many things will be changed.”

“I don’t think people will take things for granted. I think they will be cautious with their health, money and family.”

‘Going Out’ By ‘Staying In’: They also look for changes in the way people approach conventionally social activities such as shopping, dining out, attending large gatherings, and travel, which are expected to trend towards remote/tele-participation, online shopping/home delivery, and a lingering distrust of large gatherings.

“We will think twice before going to larger events. The entertainment industry, restaurants, bars, and the travel industry will suffer for who knows how long.”

“Stores will be open fewer hours, with fewer employees. More cleaning in public transit and restaurants and gyms. Not as many youth sporting events. People will be staying at home for a while.”

But what are the wider implications of these findings for the companies and brands seeking to thrive in the coming months? Here are some potential implications:

Consumers anticipate a profound shift in both behaviors and attitudes—and marketing to this emerging “coronavirus consciousness” may require a shift in tone or message.

Anticipated changes in social interactions include not just a focus on hygiene related behaviors like handwashing but also changes in underlying attitudes and perceptions that could have far wider implications for consumer behavior moving forward.

Of course, brands and products whose benefits are already in sync with the behaviors of social distancing, like fitness brand Peloton, are likely to see a real opportunity for growth in this environment.

But other brands that can align with this shift in public attitude also stand to benefit. Notably, this cautious mindset may be driven as much by visceral emotion as by rational thought. These emotional overtones could mark a significant—and possibly lasting— shift in how some consumers feel about their lives and the world around them. Tapping into this new emotional posture may be essential for marketers looking to connect with consumers in the months and years ahead.

This increasing social caution is being driven first and foremost by health concerns, so brands that can tout their health benefits should do so.

Unlike a national security crisis like 9/11 or an economic crisis like 2008’s housing bubble, the COVID-19 outbreak is predominantly health-focused, and its social impact will likely be driven to a large extent by health concerns.

It follows that the public will likely be more receptive to messaging that emphasizes health benefits, particularly if they can be connected to the outbreak. So products that can legitimately claim to boost the human immune system or have anti-viral hygienic properties clearly stand to benefit if they make a compelling case.

But the implications go much further than that. For example, links between chronic conditions like obesity and diabetes and COVID-19 mortality rates might be a boost for products that address overall health or weight loss/maintenance in particular, adding a new emotional impetus to the public’s desire to manage their weight and maintain as healthy a body as possible.

Consumers anticipate a transition period rather than a quick return to normal—and the transition could take a long time.

That so many consumers foresee long-term social impacts even after the threat of the virus has receded suggests that these new attitudes could linger for some time, though for how long is anyone’s guess. However there are historical precedents in the psychological ramifications of events like the Great Depression or the Great Recession that continued impacting the way people thought about employment and economic security for years.

It makes sense, though, that the longer the current crisis goes on, the greater its impact on the “new normal” that follows. And there are unpleasant hints that the crisis could go on for longer than many people seem to expect. As Ed Yong writes in The Atlantic:

It’s likely that the new coronavirus will be a lingering part of American life for at least a year, if not much longer. If the current round of social-distancing measures works, the pandemic may ebb enough for things to return to a semblance of normalcy. Offices could fill and bars could bustle. Schools could reopen and friends could reunite. But as the status quo returns, so too will the virus. This doesn’t mean that society must be on continuous lockdown until 2022. But “we need to be prepared to do multiple periods of social distancing,” says Stephen Kissler of Harvard.

So if March felt like it lasted a year, how much will people’s perceptions shift if this goes on for another two or four or six months? As one respondent put it:

“The longer this pandemic lasts and affects our daily lives, the more we are likely to change how we work, shop and live our lives in the future. The bigger this crisis is, the more likely it will have lasting impact.”

We’ll be continuing to track consumer sentiment around these and other emerging issues over the next few weeks. For more information about Pathfinder Text Science or this research in particular, please contact us to set up some time for us to take you through our findings.