Since early March, MAi Research has been conducting a tracking study to understand people’s reactions to the coronavirus outbreak, delivering insights to clients and businesses. We’ve been delving deep into the emotional side of this crisis, and with recent increasing pressure to “reopen America” we decided to shift our research toward understanding attitudes and emotions around this idea.

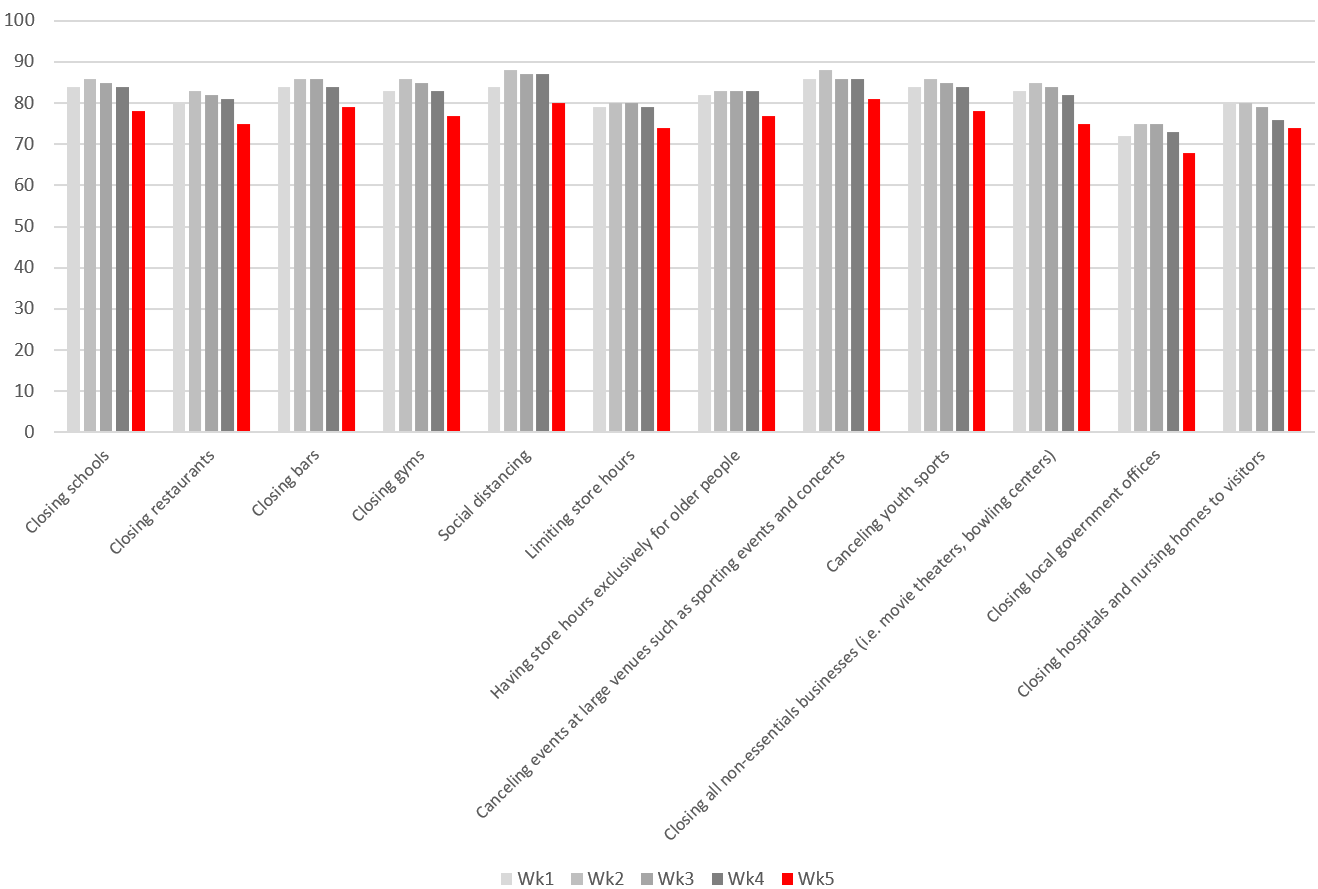

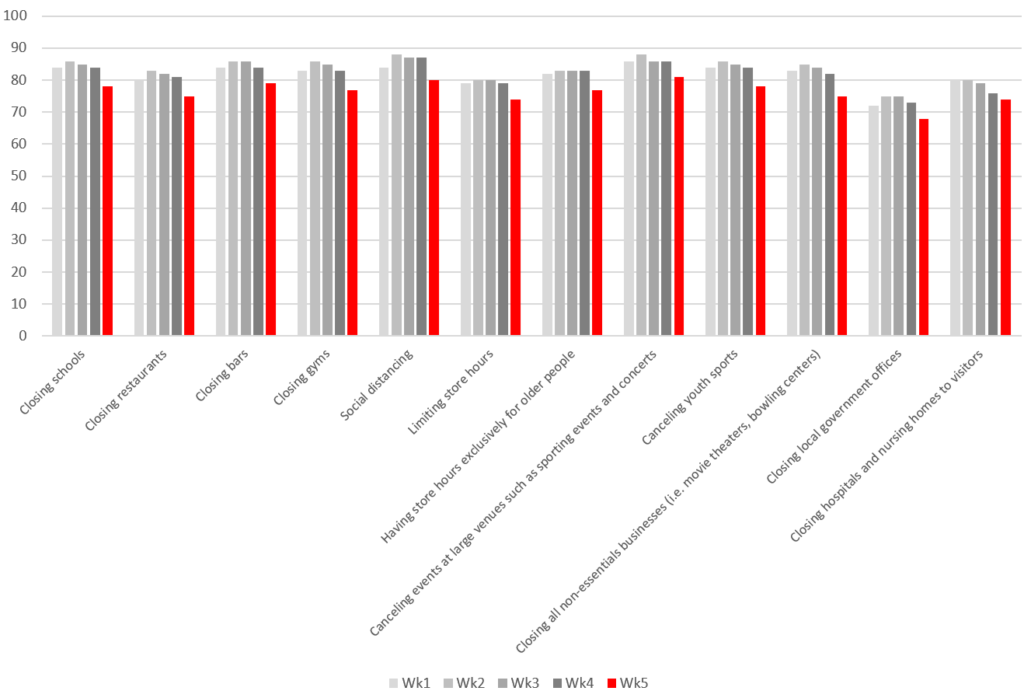

In our longitudinal results, we have seen steady and consistently high levels of agreement with regulations that have been implemented – until this week. In our most recent measures, we saw a statistically significant decrease in agreement across ALL types of regulations we measure. It appears that while most people still agree with these measures, these attitudes are beginning to change.

Q: How much do you agree or disagree with the following regulations that have recently been implemented in many places? (% Somewhat/Completely Agree)

Last Friday, we inserted questions on the tracker to begin understanding consumer perspectives on re-opening and engaging in activities that have been affected by the coronavirus outbreak. We wanted to understand whether, to paraphrase Field of Dreams, “if we opened it, they would come.”

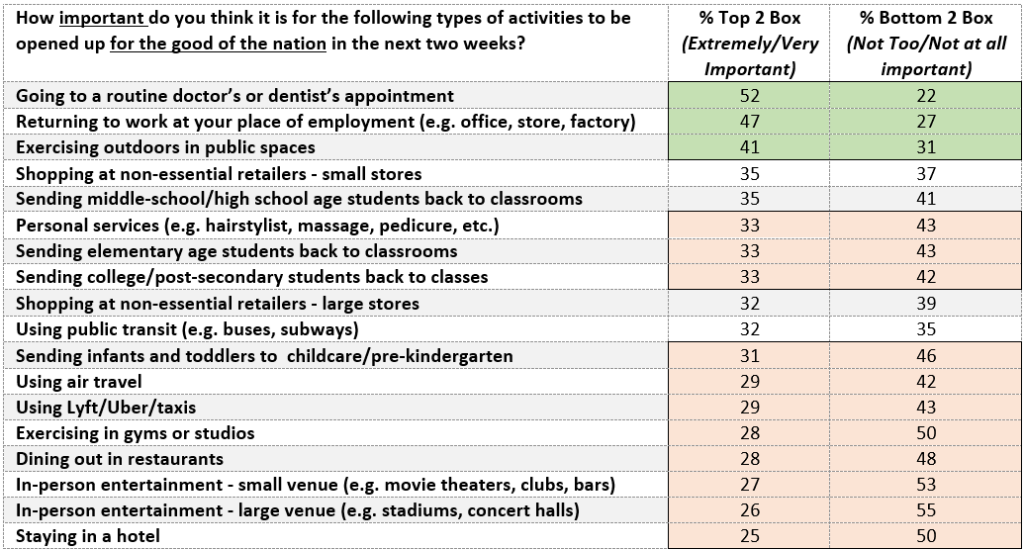

With a pre-defined, near-term window, we find that more people see a few certain types of services and experiences as important to be reopened, while many activities are seen as having lower perceived importance:

* Green/orange shading notes statistically significant differences between the two groups at 90% confidence level.

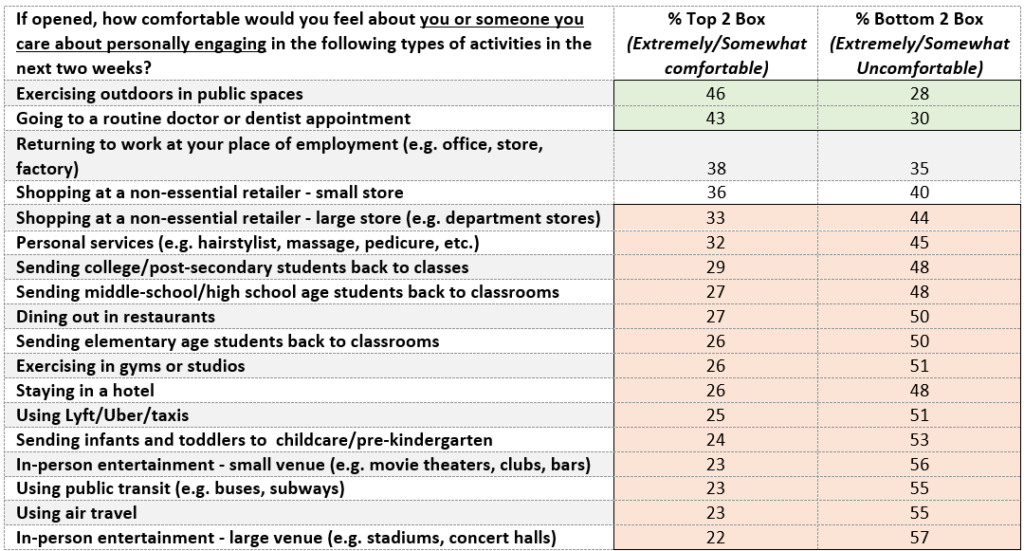

We also asked people how comfortable they would feel for themselves or someone they cared about to engage in these activities in the same time frame. For most factors, we see greater levels of discomfort when activities are framed in the setting of personal participation.

* Green/orange shading notes statistically significant differences between the two groups at 90% confidence level.

Notably, there are several areas where higher perceived importance is paired with lower levels of comfort:

- Going to a routine doctor’s/dentist’s appointment

- Returning to work

- Using public transit

- Sending high school, middle school, elementary, and pre-k/daycare children back to school

This disconnect demonstrates areas where tension is likely to be experienced first – where people will need to/want to re-enter public life, but will feel uncomfortable with the perceived risk. These types of tension are often indicators of opportunity for innovation (ex. the surge in telemedicine).

There are also areas where lower perceived importance pairs with high discomfort:

- In person entertainment (large and small venues)

- Using air travel

- Exercising in gyms or studios

- Staying in a hotel

- Using public transit

*Note: Specific demographic sub-populations place higher importance on air travel and public transit than was reflected for the overall population.

In all likelihood, these industries are going to experience much longer recovery periods and should consider pivoting financial models to incorporate slower revenue growth and manage costs to offset revenue growth risks. The best means to offset these financial impacts should include taking strong and immediate steps to address consumer concerns.

We also found that different demographic groups demonstrated different levels of openness/comfort with re-opening – some of which might be surprising. Comparatively:

- Women showed higher levels of comfort than men across most factors

- People in the Northeast showed many areas of lower comfort and importance than was seen in other regions.

- People aged 25-44 had higher comfort than those older and younger

- People with higher incomes (over $75k/year) had higher comfort than those with lower incomes

Interesting side note: The highest income respondents had higher rates of agreement with it being important for the nation to open up for multiple factors… but were less comfortable with personal engagement than those with mid-range incomes. Perhaps it’s a case of “Let them eat the cake first…?”

What this means for businesses:

We’ve given a very high level, initial look at how people feel about relaxing precautions in the near future. As has been demonstrated, there is much reluctance to re-engage in the public sphere – even as people begin to chafe at the strictures that have been imposed. Our guidance:

- Proceed with caution: expect slow behavioral change back to personal public engagement.

- Keep pace with consumers’ changing behaviors. Structure marketing and communications programs to focus on gaining both incremental online business and competitive market share.

- As certain state governments have indicated they will be opening sooner, use a “test and learn” approach to gain quick insights from these markets to apply to those who are more cautious about re-opening.

- Identify ways to demonstrate empathy, as we’ve discussed previously – especially if you’re dealing with a targeted demographic that is less comfortable with re-engaging.

We will be continuing to explore these themes and more in future publications as well. Please reach out if you would like to discuss ways that MAi/Pathfinder Analytics can help you navigate through these next stages into a post-Corona world.