Pathfinder Analytics Case Study

KEY INSIGHTS:

- Consumers are mostly positive about hemp as an ingredient for personal care products.

- Hemp’s close association with marijuana/cannabis is viewed neutrally (few strong positive or negative reactions), though the cannabinoid THC tends to be polarizing.

- Top Benefits: healthy, natural, and possessing healing/soothing properties

- Top Barriers: bad-smelling, irritates sensitive skin

- Younger Consumers (<40): focus on healing/soothing benefits and being natural/organic

- Older Consumers (40+): emphasize anti-aging and antioxidant benefits

Research Background

Recent years have seen a sea-change in public perceptions of cannabis and cannabis-related products like cannabidiol (CBD), hemp, and THC — a shift fueled in no small part by increasingly effective cannabis legalization efforts.

Yet recreational cannabis usage continues to be polarizing for the US at large: while legal in 19 states and decriminalized in another 12, it remains prohibited at the federal level in what some refer to as a “state vs. federal limbo” — a situation that even Joe Biden seems reluctant to change.

Regardless of this confusion, a dynamic new market is emerging that encompasses not only cannabis in its traditional forms, but products incorporating related ingredients like CBD, hemp, and THC.

So just how far have consumer attitudes shifted? And how can a brand quickly and effectively explore the product innovation possibilities in this rapidly emerging market?

Pathfinder Analytics developed our proprietary Text Science methodology to answer questions like these — a simple and cost-effective way to collate, quantify, analyze, and summarize any amount of unstructured text data from any source. With open-ended questioning and large sample sizes, Text Science combines the insight of qualitative research with the robust analysis and projectability of quantitative methods.

To demonstrate the value of Text Science for an emerging market like this, Pathfinder explored consumer reactions to hemp as an ingredient for personal care products. Given that up to a third of Americans mistakenly believe that hemp and marijuana are the same plant, we expected to find a strong connection between the two in consumers’ minds — but how would it impact their likelihood to try a hemp-infused product?

To find out, MAi/Pathfinder:

- Interviewed 933 gen pop consumers ages 18-54

- Used open-ended questions to elicit respondents’:

- General associations with hemp,

- Benefits they would associate with hemp-infused personal care products (body/facial washes, moisturizers, hand soaps, etc.),

- Concerns they might have about using hemp-infused personal care products.

Consumers (Mostly) Approve of Hemp

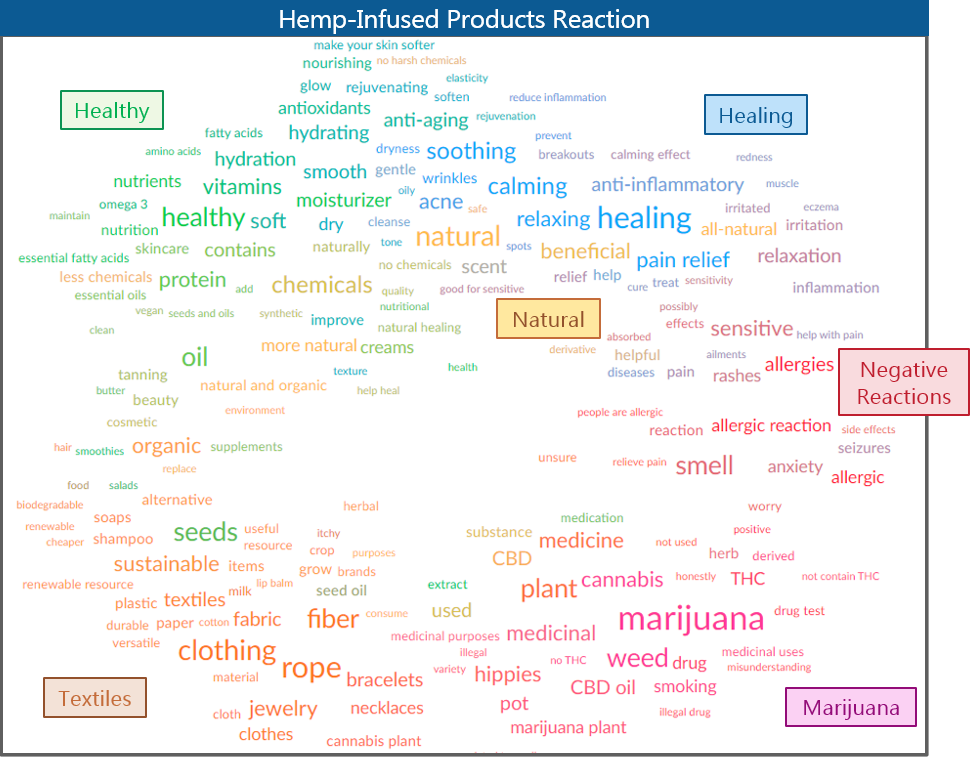

Consumer associations with hemp tend to focus on its health benefits, potential negative reactions, and its connection with marijuana/cannabis:

As the map indicates, hemp associations fall into six distinct (and color-coded) themes or topics:

- The strongest themes focus on hemp’s healing properties, (including being soothing, calming, and relaxing) its health benefits, and possible negative reactions in the form of unpleasant smells or skin reactions. Altogether these themes account for fully 72% of the terms on the map.

- Secondary themes address hemp’s many textile uses (including its sustainability), its connection to marijuana/cannabis, and its status as a natural ingredient (as opposed to artificial ingredients or chemicals).

Key Issues: Health Benefits and Marijuana Associations

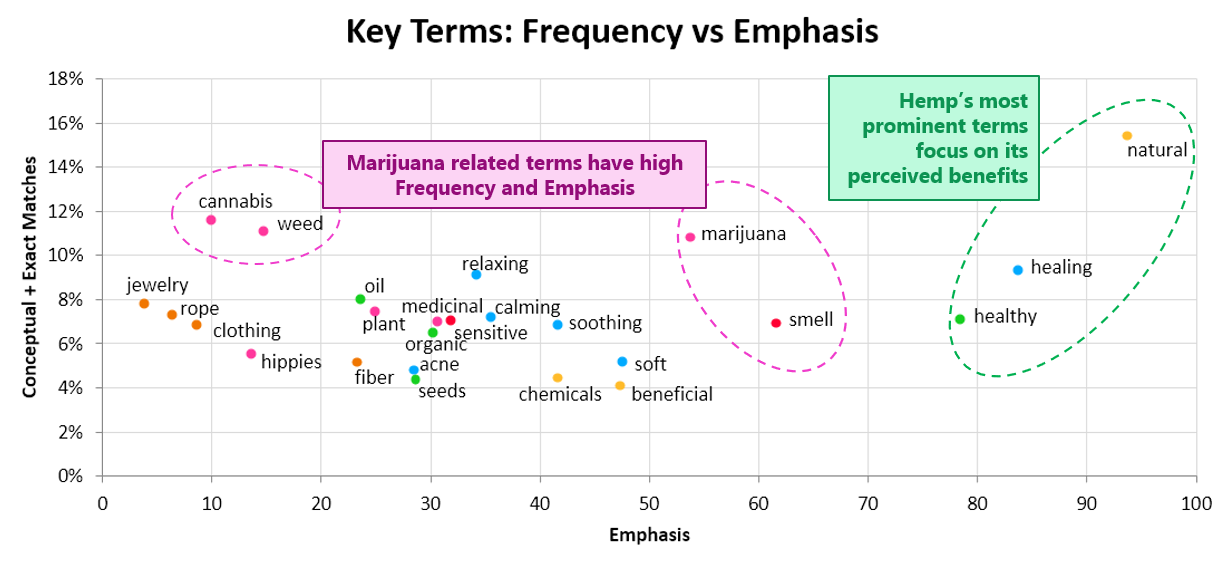

To help our clients focus on the most important terms on a text science map, we look at two key metrics: The number of Total Matches a term has (both exact mentions and conceptual matches), and its relative Emphasis (how important it tends to be to the data’s overall ‘conversation’).

When we graph these metrics for the hemp-infused data, a handful of terms rise to the top: Three key product benefits (natural, healing, and healthy) and several marijuana/cannabis-related terms:

The combination of high match counts and high emphasis scores indicates that these terms are important to understanding consumers’ hemp perceptions. But to understand what they mean to consumers we need to know how consumers are using them.

Sentiment Analysis: High on Healing

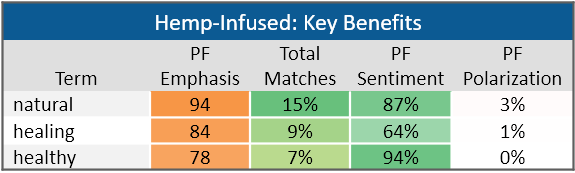

Pathfinder’s Text Synopsis measures key metrics for all terms, including Total Matches and Emphasis as well as Sentiment and Polarization.

Sentiment reveals how a term is being used, from totally positively (+100%) to totally negatively (-100%), while Polarization shows how polarized that sentiment is, from totally consistent (0% — i.e. everyone agrees) to highly polarizing (+100% — an even split between positive and negative).

Looking at the text synopsis for hemp’s three key benefits shows that consumers use all three with strong positive sentiment, particularly natural and healthy:

It should be noted that these are the top three terms by emphasis on the map overall, and so may be particularly effective in brand and product messaging.

“Being a natural ingredient it probably has more beneficial effects than a lot of the added chemicals that go into other products. I think it would be better for you.”

“I would assume the product is all-natural with no toxic ingredients — something safe for me and also safe for the environment.”

Sentiment Analysis: Muted on Marijuana

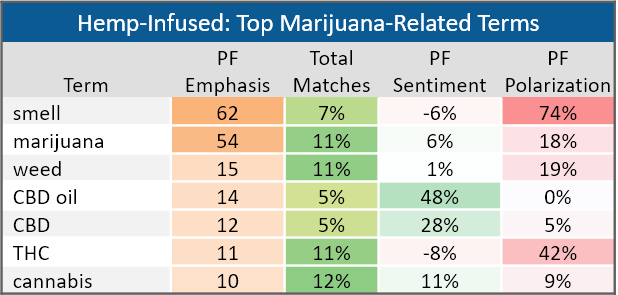

Most of the second tier terms related to hemp’s marijuana connection tend to be used with neutral sentiment:

Only two marijuana-related terms are polarizing: concerns about the product’s smell, and the possible psychotropic effect of THC:

“The smell of hemp is not great — it smells strange and organic.”

“Some people might not want hemp in it because they mistakenly think hemp has THC in it and it will be like using drugs.”

Perceptions of CBD and CBD oil, on the other hand, are more positive than negative:

“I think that hemp is used to make CBD oil, which is for pain relief. I know it’s a growing trend to use hemp and CBD oil.”

Making Hemp Age Appropriate

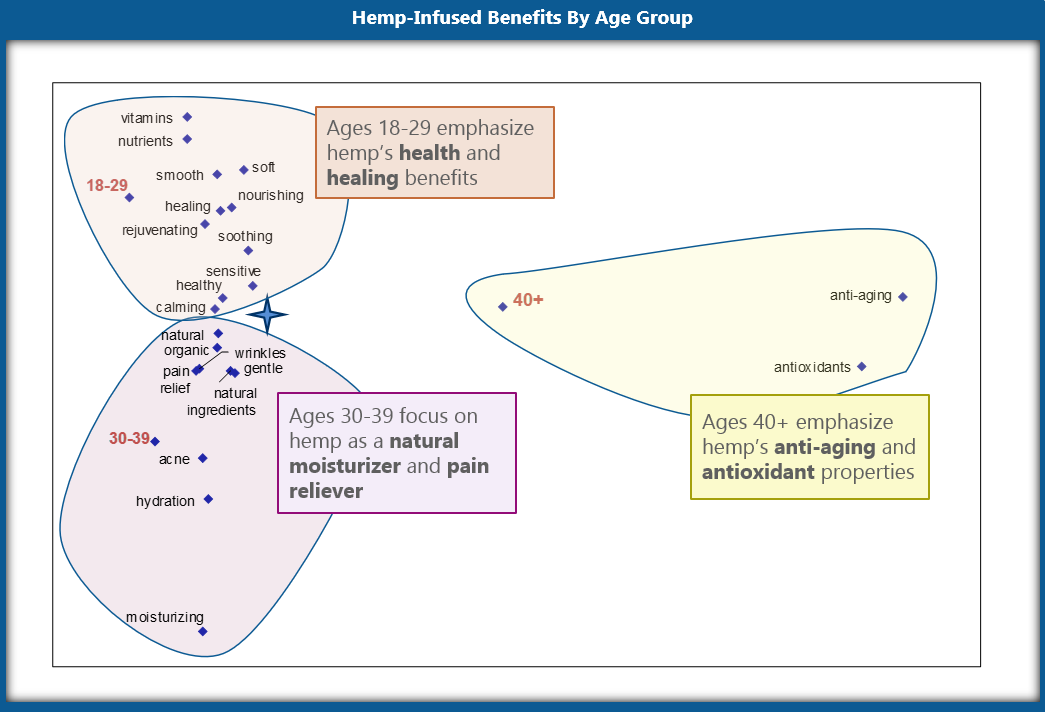

Perceived hemp benefits vary by age group, with younger consumers being more focused on healthy moisturization and older respondents on anti-aging benefits:

- 18-29 year-olds emphasize hemp’s health and healing benefits, including its nutrients and vitamins and its calming, soothing

- Those 30-39 are more focused on hemp being a natural and organic ingredient that provides gentle pain relief and moisturization/hydration.

- Ages 40+ stand out for their focus on hemp’s antioxidants and anti-aging

Findings and Implications

Overall: While there is some confusion regarding hemp’s connection to marijuana/cannabis, consumers overall have mostly positive associations with hemp and hemp-infused personal care products. Hemp is seen as a healthy, natural ingredient with a variety of healing and soothing properties, as well as a number of other benefits (e.g. anti-inflammatory, pain relief, hydrating/moisturizing).

“Hemp has many natural healing properties, so I can only imagine that using it would have a positive impact.”

Implications: Overall brand and product messaging should focus on hemp as a natural, healthy ingredient that is capable of healing a variety of ailments.

More specific benefits like inflammation reduction should also be framed within this ‘natural, healthy healing’ context (e.g. by focusing on hemp oil’s naturally occurring essential fatty acids and their anti-inflammatory properties).

Marijuana Connection: While hemp is strongly associated with marijuana and cannabis, consumers tend to view marijuana and cannabis in a fairly neutral light. Hemp is also associated with CBD/CBD oil, which consumers tend to view more positively. While these associations are widespread, they don’t appear to have a negative impact on most consumers’ hemp perceptions.

“To me it has always been a product that is related to marijuana and stoners and hippies, but recently I have been hearing about the health benefits.”

Implications: While actively touting a hemp-infused product’s marijuana/cannabis connection might turn off some, consumers’ existing perceptions seem unlikely to present much of a barrier to product trial.

Hemp Concerns: Consumers biggest concerns about hemp-infused products are the product smelling bad or provoking a skin reaction (especially for those with sensitive skin).

“The scent concerns me, as does possible skin irritation, since not all natural ingredients are good for sensitive skin.”

Implications: Both initial product formulation and product messaging should be designed to counter smell and skin reaction concerns: first by producing a product with an appealing scent that is gentle on sensitive skin, and then by effectively communicating these benefits to overcome any consumer doubts and encourage trial.

Age-Appropriate Messaging: Perceived hemp lotion benefits vary by age group, with younger respondents more focused on healthy moisturization and older respondents on anti-aging benefits.

Implications:

- For under-30s, emphasize hemp’s health and healing benefits, calling out specific vitamins and nutrients, and reference its ability to soothe and nourish the user.

- Target ages 30-39 with language that focuses on hemp as a natural and organic ingredient that provides gentle pain relief and moisturization/hydration

- For those 40+, place particular emphasis on hemp’s anti-aging and antioxidant

Looking Ahead

This data supports the general finding that public attitudes towards cannabis, hemp, and similar products are indeed softening, in step with the rising tide of cannabis and cannabinoid legalization. What might this mean for the category beyond familiar product types like vape pens and edible baking mixes? That will depend on the ingenuity and enterprise of the companies who decide to play in this sandbox. The opportunity is there — but so is the risk.

Whether in the cannabis-related category, or any other category, Pathfinder’s Text Science can use any source of unstructured text, including survey responses, call center transcripts, bulletin board posts, focus group transcripts, consumer product reviews, and social media.

This flexibility allows Text Science to be incorporated into any research that involves collecting or analyzing open-ended data, including:

| Whitespace Exploration | Discover underutilized brand positioning opportunities via brand/service assessments, subgroup comparisons, and perceptual mapping. |

| Brand Messaging | Learn to focus on the benefits, emotions, and occasions that mean the most to consumers — and to use the specific words and phrases that will have the greatest impact. |

| Concept Testing | Assess concept impact, persuasiveness and communication profile by exploring consumers’ unfiltered reactions. |

| IHUT / New Product Testing | Explore consumers’ in-the-moment reactions to new products to learn how you can improve the product experience. |

| Online Perceptions Evaluation | Analyze consumers’ online text data (from reviews to social media) to evaluate strengths and weaknesses of a brand, product or service. |

| Comprehensive Segmentation | Better understand and message to your key segments by discovering each segment’s drivers of choice. |

For more information about Pathfinder Text Analytics or this research in particular, please contact us to set up some time for us to take you through our findings and find ways we might help you learn more about your customers and how they perceive and interact with your brand and your products.